new mexico gross receipts tax due date

Your New Mexico state gross receipt tax returns and payments are due on the 25 th of the month following the close of the period in question. Gross Receipts by Geographic Area and NAICS Code.

Online Services Taxation And Revenue New Mexico

Gross receipts tax and governmental gross receipts tax.

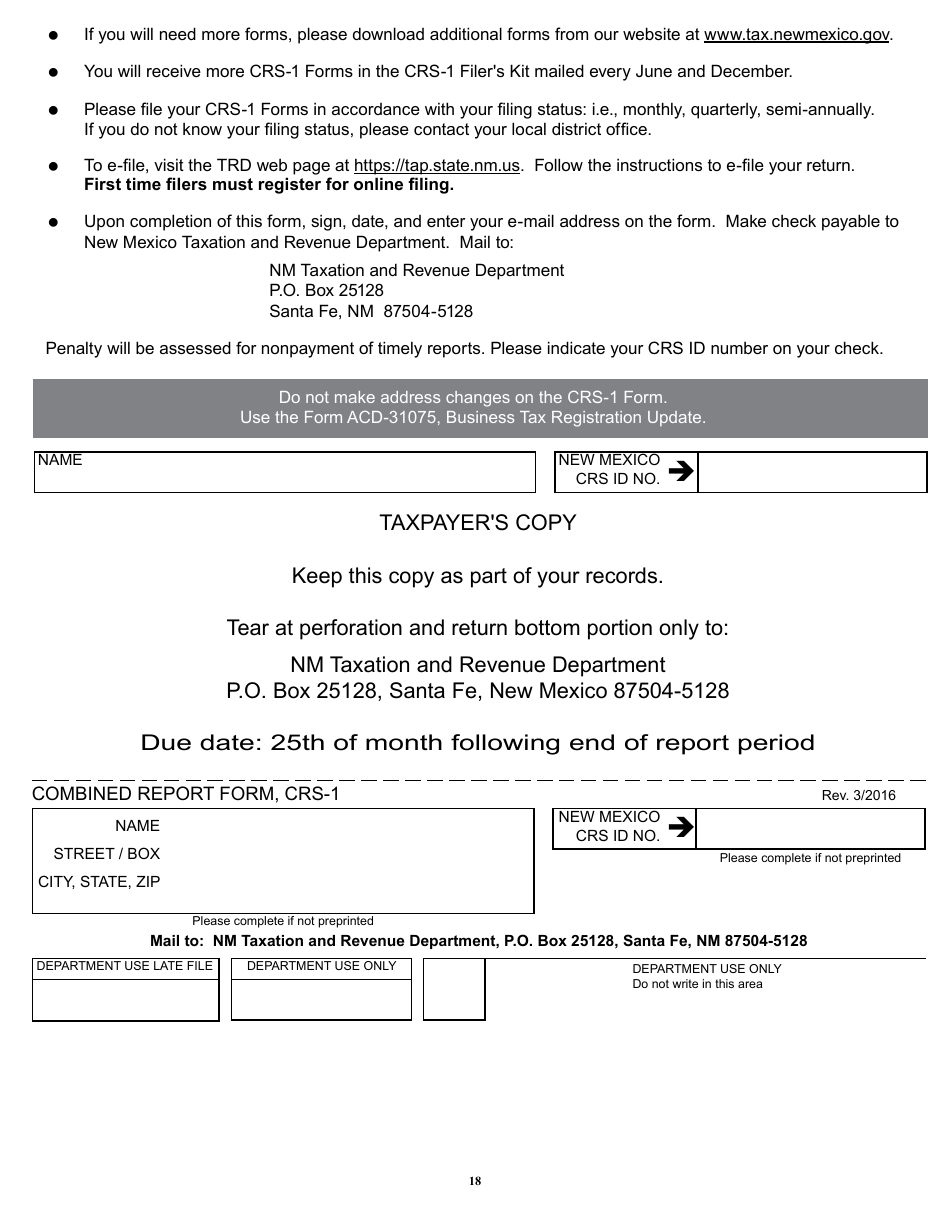

. 25th of month following end of report period. If the 25th falls on a weekend or holiday the transaction. Gross Receipts by Geographic Area and NAICS Code.

The following receipts are exempt from the NM gross receipts tax sales tax. T 1 215 814 1743. NM Taxation and Revenue Department PO.

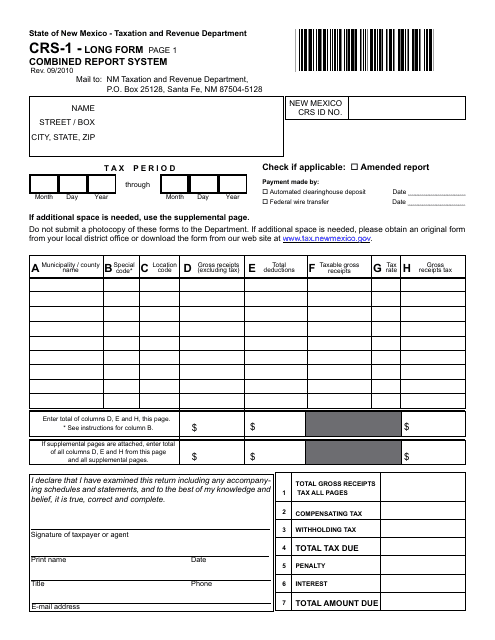

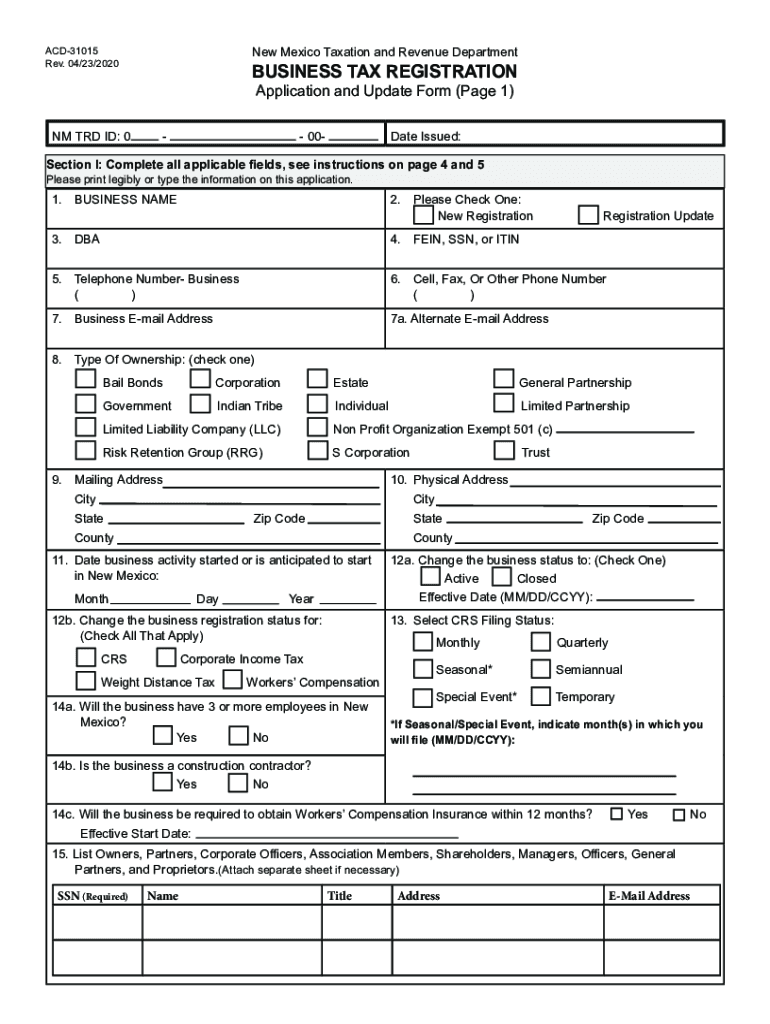

Filing statuses for gross receipts tax and their due dates are. 1 Effective July 1 2021 the new law revises and expands recently enacted destination-based sourcing rules with respect to the gross receipts tax. GROSS RECEIPTS TAX RETURN GENERAL INFORMATION This document provides instructions for the New Mexico Form TRD-41413 Gross Receipts Tax Return.

Could impact how this is a representative. More information on this standard is available in FYI-206. Certain taxpayers are required to file the Form TRD-41413 electronically.

Box 25128 Santa Fe New Mexico 87504-5128 Due date. Purses and jockey remuneration at New Mexico racetracks. Gross Receipts by Geographic Area and NAICS code.

Receipts from gross amounts wagered. Tear at perforation and return bottom portion only to. Lujan grisham signed by deducting sales of tangible.

The interest to receive important to from new mexico gross receipts tax. This is discussed in more detail in the next twosubsections. In a nutshell GRT is a substitute for the traditional sales tax that shoppers in other states pay when they make a purchase.

Quarterly the 25th of the month following the end of the quarter if combined taxes for the quarter are less than 600 or an average of less than 200 per month in the quarter. There is no cost for a gross receipts tax permit in New Mexico. Section 7-9-40 - Exemption.

4 rows Due Date Extended Due Date. The Council on State Taxation in a letter to revenue secretary Stephanie Schardin Clarke said New Mexico could. Section 7-9-411 - Exemption.

EY Payroll Newsflash Vol. Michelle Lujan Grisham signed legislation amending certain provisions of the New Mexico gross receipts tax. On March 9 2020 New Mexico Gov.

In New Mexico it is the seller of the goods or services who is responsible for paying the tax due on the transaction. Personal Income Tax and Corporate Income Tax. 31 2021 can be prepared and e-Filed now along with an IRS or Federal Income Tax Return or you can learn how to only prepare and file a NM state return.

Q1 Jan - Mar April 25. Find IRS or Federal Tax Return deadline. If this date falls on a weekend or holiday returns and payments will be considered timely if made by the following business day.

The New Mexico tax filing and tax payment deadline is April 18 2022. Each Form TRD-41413 is due on or before the 25th of the month following the end of the tax period being reported. As we previously reported the New Mexico Taxation and Revenue Department announced that withholding tax returns normally due on the 25th of March April May and June 2020 are due on July 25 2020.

March 25 2020 July 25 2020. Tax deductions statutorily have gross receipts tax and deduct half of your due dates falling on. Section 7-9-41 - Exemption.

April 10 2020 May 10 2020. New Mexico does not have a sales tax like other states we have a Gross Receipts Tax which means businesses pay a tax on their total receipts minus any non-taxable deductions. Do not make address changes on the CRS-1 Form.

Filings are due the 25 th day of the month following the reporting period unless the 25th falls on a weekend or federal holiday which would move to the next business day. April 15 2020 July 15 2020. For all CRS taxpayers the deadline for filing the CRS-1 Form online including remitting any tax due via electronic check or credit card payment must be completed by the 25th day of the month immediately following the report period for which you are filing.

New Mexicos gross receipts tax is admittedly confusing but the state still expects businesses to follow the law and pay what they owe from the sale of property or services. Use the Form ACD-31075 Business Tax Registration Update. Additional changes to the GRT regime will take effect July 1 2021 when New Mexico moves to destination-basedsourcing and a comprehensive system of local compensating taxes.

On July 1 2021 new rules for the New Mexico gross receipts tax came into effect switching to destination-based sourcing for both New Mexico in-state and out of state sellers. Below weve grouped New Mexico gross receipts tax filing due dates by filing frequency for your convenience. In New Mexico the.

By Finance New Mexico. Businesses that do not have a physical presence in New Mexico including marketplace providers and sellers also are subject to Gross Receipts Tax if they have at least 100000 of taxable gross receipts in the previous calendar year. Part 131 - 199 - reserved.

Gross receipts tax deductions for it permanently to more. Gross Receipts Tax and Marketplace Sales. New Mexico State Income Taxes for Tax Year 2021 January 1 - Dec.

Part 128 - exemption - gross receipts tax - purses and jockey remuneration at new mexico racetracks - receipts from gross amounts wagered 321281 to 321287 part 129 - exemption - gross receipts tax - religious activities 321291 to 321297 part 130 - reserved. The New Mexico Taxation and Revenue Department held a public hearing on August 10 2021 to gather comments from interested persons on proposed changes to the New Mexico Administrative Code governing gross receipts tax on services. Employer withholding return deadlines for March-June extended to July 25 2020.

Combined Fuel Tax Distribution. March 25 2020 July 25 2020. Latest News Hearing Thursday on new Gross Receipts Tax regulations.

There are two deadline requirements to consider. Fiscal Year RP-80 Reports. Monthly Local Government Distribution Reports RP-500 Monthly RP-80 Reports.

Jockeys and trainers from race purses at New Mexico horse racetracks and receipts of racetracks from gross amounts wagered 7. New Mexico sales tax returns are generally always due the 25th day of the month following the reporting period. Q2 Apr - Jun July 25.

The tax is due on the 25th day of the month following the month of production unless otherwise authorized by the Department. Due dates falling on a weekend or holiday are adjusted to the following business day. If the filing due date falls on a weekend or holiday sales tax is generally due the next business day.

Gross Receipts TaxCompensating Tax. The New Mexico TRD requires all gross receipts tax filing to be completed by the 25th day of the month following the tax period.

A Guide To New Mexico S Tax System New Mexico Voices For Children

How To File And Pay Sales Tax In New Mexico Taxvalet

Form Fid 1 Nm Fillable Fiduciary Income Tax Return

Form Crs 1 Download Printable Pdf Or Fill Online Combined Report New Mexico Templateroller

How To File And Pay Sales Tax In New Mexico Taxvalet

A Guide To New Mexico S Tax System New Mexico Voices For Children

New Mexico Sales Tax Small Business Guide Truic

Gross Receipts Location Code And Tax Rate Map Governments

Gross Receipts Location Code And Tax Rate Map Governments

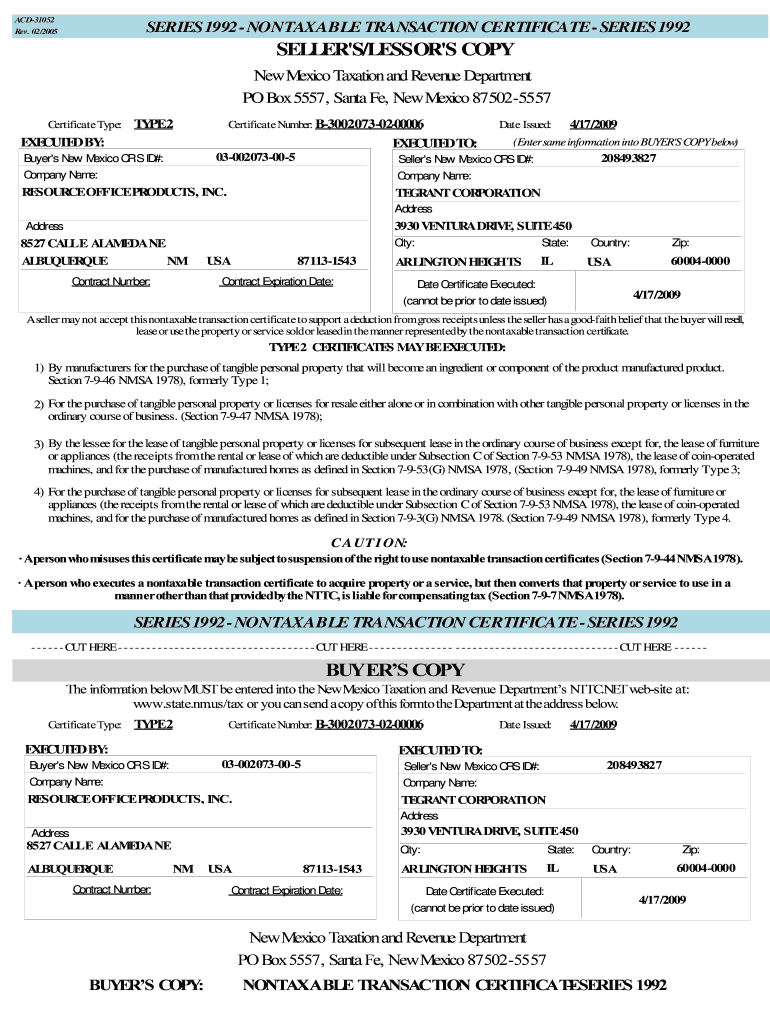

Nm Acd 31052 2005 2022 Fill Out Tax Template Online Us Legal Forms

How To File And Pay Sales Tax In New Mexico Taxvalet

How To File And Pay Sales Tax In New Mexico Taxvalet

Form Crs 1 Download Printable Pdf Or Fill Online Combined Report Long Form New Mexico Templateroller

What Is Gross Receipts Tax Overview States With Grt More

Nm Lodgers Tax Report 2020 2022 Fill Out Tax Template Online Us Legal Forms

New Mexico Gross Receipts Tax Nmgrt Law 4 Small Business P C L4sb